Life Insurance with Living Benefits

Life Insurance you don’t have to die to use!

Our Life Insurance policies are built with living benefits that allow you to access your policy’s cash benefits in case you were to suffer a terminal or chronic illness, such as heart attack, stroke, or cancer diagnosis – or in case of a critical illness. It can be a life changing feature that is revolutionizing the life insurance industry.

An Accelerated Benefits Riders is an optional rider that can allow you to access all or part of your death benefit, while you are still alive if you were to experience a qualifying terminal, chronic, or critical illness.

The benefit is unrestricted so that once you qualify, you can use the benefit for any expense you choose.

Expenses might include, but are not limited to:

- Household expenses

- Adult Day Care

- Home modifications

- Regular bills

- Nursing home care

- Quality of life expenditures…WHATEVER!

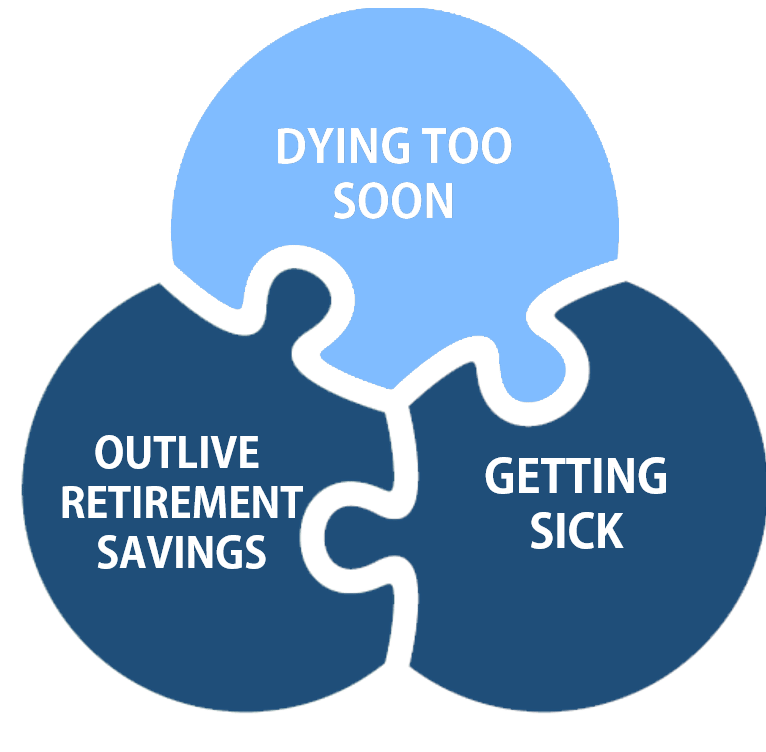

Life insurance can help provide financial security during one of life’s most difficult times: the death of a loved one.

But few people know that life insurance can also help during another one of life’s most difficult times: a chronic, critical or terminal illness.